Money Management Tools

Budget

A budget is an allocation and tracker for every dollar you make and spend, and it is the ultimate finance tool to help you achieve your goals. A budget is the cornerstone of personal finance. It provides a crystal-clear picture of financial health and aids in making decisions to improve financial wellbeing.

It may be difficult to keep track of what was spent each month. Fixed expenses, like rent and car payments may be consistent each month, and easier to remember. Expenses that vary, or change, can wreak havoc in a spending plan. Keeping track of spending allows you to figure out where your money goes each month. There are many ways to keep track of spending.

- Pencil & Paper: Write down your expenses right away. Keep pen and paper available in your purse, car, or pocket.

- Spreadsheet: Make up your own spreadsheet or use a ready made template.

- Gather Receipts: Place ALL receipts into a basket, box, or envelope. At the end of the month, add up each spending category. If you didn’t get a receipt for an expense, just record amount on paper and place with the other receipts.

- Daily Calendar: Write all income and expenses on a calendar each day. At the end of the month, add up each spending category.

- Software & Apps: Enter spending and income into a money management software or application that can total the spending categories at the end of each month. There are free programs and apps (goodbudget.com) that can assist with monitoring spending. Spreadsheet software is another option, but may need to be purchased depending on software utilized. For more detail and ability, personal financial management software, such as Quicken, can be purchased.

- Financial Institutions: Banks or credit unions may offer online services, such as expense tracking. Check with your financial institution to see if this is offered.

- Other: There is no right or wrong way to keep track of spending. You should utilize a system to monitor spending that works best for you.

An emergency fund is a bank account with money set aside to pay for large, unexpected expenses, such as:

- unforeseen medical expenses

- home-appliance repair or replacement

- major car fixes

- unemployment

- should be 3-6 months of living expenses

For more info, visit: https://www.cashcourse.org/Topics/Protect/Emergencies/Just-in-Case-Building-an-Emergency-Fund

Savings Goal Calculators:Calculate how long to reach a goal or monthly payment calculator

Compounding Interest. Calculate savings account interest.

Auto Loan Payment. Determine your estimated monthly auto loan payment.

Credit

Think of your credit score as a kind of financial GPA: Your goal is to keep improving it, and then maintain it when it’s the highest you can achieve. Always strive to keep it higher than it is currently. And if you’ve recently earned a failing grade—say, in the form of making late payments—you’ll need to work that much harder to raise your score!

With a credit card comes financial responsibility and independence. Overspending, high interest rates, and not being able to pay off your balance each month pose risks to college students, which can affect them into adulthood. However, the benefits of a credit card, include establishing credit history and demonstrating responsible use of credit, can both play a role in elevating a credit score for future loans when ready to purchase a car or home. There is not a definitive answer to this question, but each individual needs to make their own decision based on an assessment of their personal financial situation.

When used correctly and responsibly, credit cards can help you build credit prior to graduation. Many major credit card users offer cards designed for students with little to no credit history. Conduct your research, check online articles, and do your homework while taking special notice of annual fees, rewards offered, and annual percentage rates (APRs). Narrow your selection and apply to only one card, for each and every time you apply for a credit card, it is documented on your credit report and can negatively affect your credit score.

College students are regularly inundated with credit card offer invitations via mail or at events. Avoid applying for a credit card at a common table with other individuals, simply to protect identity and personal information. If applying for a credit card online, use the company's secure website from a private, password-protected Internet connection (not public Wi-Fi). Another option is to apply in person with a local financial institution, such as a bank or credit union, which can ensure privacy. Be sure to shred or destroy mailed pre-approved credit solicitations that contain your name and/or address.

Credit Scores range from 300 to 850 with a higher score being better. Having a higher score will help you get approved for loans and get lower interest rates. The score reflects a person’s ability to repay debt, and it helps creditors determine if they should lend money to you.

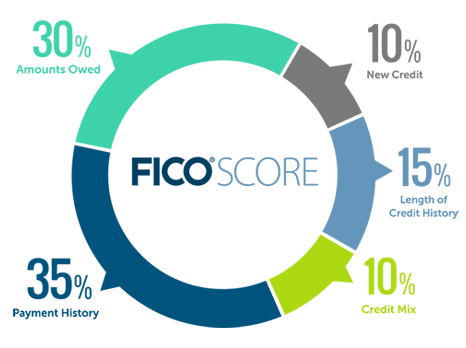

These are the factors and their weights that determine credit scores:

Payment History: is determined by whether you pay your bills on time or not.

Amount Owed: is based on how much you are currently borrowing and how much you're allowed to borrow.

Length of Credit History: is how long you have been using credit, whether it's in the form of student loans or just using a card for small items.

New Credit: is determined by the lines of credit you have opened recently (a lot is bad).

Type of Credit: is determined by how many and the types of credit you have, including credit cards, student loans, auto loans, etc.

- Credit score reflects financial well-being

- Only looks at credit and payment history, not personal wealth

- Credit inquiries hurt my credit score

- Yes and no, but mostly no.

- There’s only one credit score

- 1,000+ scoring models

- A high credit score guarantees approval for credit

- Many factors used to determine credit worthiness

There are three credit reporting agencies, credit bureaus, that collect consumer credit information and uses it to generate credit scores. Each one takes different factors into consideration which can cause you to have three different credit scores:

|

|

|

| Equifax empowers businesses and consumers with information they can trust. With a strong heritage of innovation and leadership, we leverage our unique data, advanced analytics and proprietary technology to enrich the performance of businesses and the lives of consumers | Experian We are the leading global information services company, providing data and analytical tools to our clients around the world. We help businesses to manage credit risk, prevent fraud, target marketing offers and automate decision-making. | TransUnion Our mission is to help people everywhere access the opportunities that lead to a higher quality of life. By helping organizations optimize their risk-based decisions and enabling consumers to understand and manage their personal information, we empower both to take their destinies into their own hands. |

.

- UW Credit Union works directly with the University of Wisconsin Whitewater to offer a banking solution for students.

- Our Campus Package fits your busy lifestyle. Take care of all your banking needs quickly and easily by opening a Campus Package online or by stopping by one of our convenient campus branches.

- The Campus Package free services:

- Checking. No minimum balance.

- Free Debit Card. Unlimited ATM transactions with no fees.

- Free Online Banking. Access to balances, statements, bill pay and Money Management Tools.

- Visa® Student Credit Card. Build credit responsibly.

- Savings Account. Be prepared for future purchases or emergencies.

- Reserve Line of Credit. Your defense against bounced checks.

- Check out these additional informational videos:

Paying for College

Here’s a quick look at the usual options for paying for college—which you can use in combination:

Grants and Scholarships

These two options provide money for your education that you don't have to pay back:

- Grants are generally awarded by the federal government or a state government. They may be awarded based on financial need, academic performance, program or area of study, or a combination of these.

- Scholarships come from federal, state, private, or corporate sources. They’re sometimes need-based. They can also be based on “merit” (achievements), specific characteristics, or in combination. Examples include:

- Academic performance

- Involvement in athletics, the arts, or other extracurricular activities

- Previous military service (your own or that of a parent)

- Career choice—nursing or teaching, for example

- Willingness to serve in the military or a service organization such as AmeriCorps or the Peace Corps following graduation

- Religious, cultural, geographic, or ethnic background

- Other factors determined by the scholarship provider

Employment

With this option, you apply earnings from a job to help with college expenses. The Federal Work-Study Program is a need-based program of employment that provides jobs for undergraduate and graduate students both on and off campus, including paid research, teaching, and resident assistantships. UW-Whitewater participates in this program.

Loans

This borrowing option requires you to pay back the money you receive—usually beginning once you're no longer in school. UW-Whitewater's financial aid office can assist you with regard to loans.

Different schools may offer different types of aid, so the best place to get help and information is your college's financial aid office.

The UW-Whitewater Financial Aid Office outlines the financial aid process in great detail. The process starts with the FAFSA application and ends with receiving the aid; however, there are many steps and potential 'hiccups' along the way. Utilize the resources and information on their site, and if there are specific questions, contact their office at (262) 472-1130.

Visit UWW Foundation Scholarship Webpage

Billions of scholarship dollars are available to people just like you! Get organized by following these steps. You’ll soon discover that finding and applying for scholarships is easier than you think.

- Complete the FAFSA Many scholarships require a completed FAFSA as part of their application requirements. Visit studentaid.gov to get started.

- Secure Letters of Recommendation Ask teachers, coaches, employers, and advisors to put in a good word for you. Request the letter a month before it is necessary with clear instructions on what is required.

- Write a Unique Essay Take something interesting from your background and make it stand out. Have you overcome adversity? Been motivated by an awesome occurrence? Use your original, yet mature, voice to stand out. Have a teacher, parent or editor review all your drafts.

- Have Documents Handy Grab your high school transcript and combine it with the documents from steps 1-3. Make sure you have both PDF and hard copies at your fingertips.

- Start Your Scholarship Search Locally Ask your financial aid office or high school guidance counselor about scholarship opportunities.

- Pick a Website That Works for You There are several websites with extensive lists of scholarships. Explore these sites and find the features that interest you. Some will send you emails with new possibilities, search the database for you, and alert you of pending deadlines.

- FastWeb: fastweb.com

- Appily: appily.com

- BigFuture: bigfuture.collegeboard.org/scholarship-search

- Scholarship America: scholarshipamerica.org

- Red Kit: myredkite.com

- Scholly: myscholly.com

- Apply to Many Scholarships. Focus on a Few. You’ll find dozens of “no essay” or sweepstake scholarships. Casting a wide net is good, but to increase your chances of success, narrow your focus when you find an opportunity perfect for you. Then be thorough. Answer optional questions and have others proofread.

Good luck with your scholarship hunt!

Loans are awarded after eligibility for grants has been considered. Student loans, like any form of loan, should be borrowed with the full realization that the money must be repaid with interest. There are several types of student loans, so it is important to understand the terms and conditions of each loan. Access your total outstanding loan balance and view your Loan Servicer contact information via the StudentAid.gov website. For more information on Federal Loans and the steps to accept and receive aid see our Financial Aid office.

For federal student loans, you should access the StudentAid website to obtain this information. You will need your Federal Student Aid (FSA) ID to log in and view your loan amounts. This ID was created when you first applied for financial aid. This site gives a total picture of your federal student loan balance.

Private student loans are not reflected at the StudentAid website. To find out your private student loan balances, you will need to seek out this information from your private lenders.

An estimate of your federal student loan repayment amount per month can be calculated using the federal student Loan Simulator. The exact monthly repayment amount will not be known until you have set up a repayment plan with your lenders.

Private loan repayment amounts can be accessed by reaching out to your private loan lenders.

Estimating cost or savings can be beneficial when planning and managing your finances. Use these calculators to find estimated answers to your financial questions.

Cost of Attending UW-Whitewater. Whether an undergraduate or graduate student, estimate your cost of attending UW-Whitewater.

Student Loans. Estimate the size of your monthly loan payment and the annual salary required to manage the loans without too much difficulty.

Student Loan Repayment. Estimate your student loan payment upon leaving college or dropping below 1/2 time status.

Employment

There are many opportunities for employment at UW-Whitewater. Handshake is the main resource for students looking for jobs on campus. Students interested in various leadership positions may want to apply to be a Peer Mentor or Resident Assistant.

Non-Residents

The Admissions Office determines a student's residency status, which is used to determine the amount of tuition a student pays. For more information on residency, contact the Admissions Office at (262)472-1440 or uwwadmit@uww.edu.

- Minnesota Reciprocity - Minnesota students must file an application with the Minnesota Higher Education Coordinating Board. This agreement is subject to annual approval by the Minnesota and Wisconsin state governments.

- Return To Wisconsin - The Return to Wisconsin residency status is available to children/grandchildren of alumni.

- Other Non-Residents - The Admissions Office awards the Academic Non-Resident Fee Remission to select incoming freshmen based on the Admissions application and availability of funding. Students must be admitted by February 1 to qualify.

Division of Vocational Rehabilitation

Students with disabilities may qualify for assistance through DVR. Vocational Rehabilitation is a Division of the Department of Workforce Development. Students should contact their DVR counselor for application information. Students must have a FAFSA on file to receive funding.

Americorps

Americorps is a program for the Corporation for National and Community Service. Members who complete their service may be eligible for an Education Award to help pay for college or pay back student loans. For more information, visit the Americorps website.

Veteran's Benefits

Visit the Veteran's Services page for information on Veteran's Benefits.

ROTC

- U.S. Air Force ROTC Scholarship and Incentives - Air Force ROTC has several types of scholarship opportunities available for students. High school seniors must apply for the Airforce ROTC College Scholarship Program no later than December 1. If selected, high school seniors are awarded three-year and four-year Air Force ROTC scholarships. For those students already in college, please contact the Department of Aerospace Studies, UW-Madison at (608) 262-3440 to find out if you are eligible for a scholarship. UW-Whitewater campus location is Room 318, Goodhue.

- U.S. Army Reserves Office Training Corps (ROTC) Scholarship - There are various scholarships available through Army ROTC - from a four-year scholarship you apply for while in high school, to a two-, three- or four-year scholarship you can get while on campus. If you are enlisted in the National Guard or the Reserves and join ROTC, there are two 2-year Guaranteed Reserve Forces Duty (GRFD) scholarships you may be eligible for. Contact the Department of Leadership, Military Science and Aerospace Studies at (262) 472-1541 or (262) 472-5250/5251 or go to the third floor of Goodhue Hall to speak to someone about Army ROTC.

Tax Credits

While tax credits are not an up front award for education, some families may be eligible to receive this benefit when they file their taxes. For more information, visit the IRS website. The Student Accounts Office will email 1098T statements by the end of January for the previous tax year.

Protecting Identity

Identity theft happens when someone uses your personal or financial information without your permission. This information can include:

- Names and addresses

- Credit card or Social Security numbers

- Bank account numbers

- Medical insurance account numbers

You may not know that you experienced ID theft immediately. Beware of these warning signs:

- Bills for items you did not buy

- Debt collection calls for accounts you did not open

- Information on your credit report for accounts you did not open

- Denials of loan applications

- Mail stops coming to or is missing from your mailbox

- Withdrawals from your bank account that are unexplainable

- Medical bills appear for services you did not utilize

- Do not answer phone calls, texts, social media messages, or email from numbers or people you do not know.

- Do not share personal information like your bank account number, Social Security number, or date of birth.

- Collect your mail every day, and place a hold on your mail when you will be on vacation or away from your home.

- Review credit card and bank account statements. Watch for and report unauthorized or suspicious transactions.

- Understand how ATM skimming works and how to protect yourself.

- Learn when it is safe to use a public Wi-Fi network.

- Store personal information, including your Social Security card, in a safe place. Do not carry it in your wallet.

- Check your credit once a year, you have the right to check your credit report at Annual Credit Report.

To report identity theft, contact:

- The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338

- The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

- The fraud department at your credit card issuers, bank, and other places where you have accounts

Use IdentityTheft.gov’s list of steps to help you recover.

If you believe you have experienced tax-related identity theft but have not received a notification from the IRS about it, learn about filing Form 14039. Completing the Identity Theft Affidavit will invalidate a fraudulent return filed using your information.

Investing

Investing means to expend money with the expectation of achieving a profit or material by putting it into financial plans, shares, or property, or by using to develop commercial venture.

Saver and Spender are friends from college, and learned from their families the importance of saving for the future. During college, Saver started to invest money after working a part-time job.

Saver placed money into an investment fund earning an average of 10%. Due to life events, Saver stopped saving at the age of 33. Saver invested a total of $24,000 over 12 years.

Spender decided to spend discretionary income from a new career on a brand-new car, travel, recreation, and entertainment. At age 34, Spender decided to start thinking about retirement and invested $2000 for the next 32 years, earning an average of 10%. Spender invested a total of $64,000 over 32 years.

Who will end up with more money by retirement? Saver had accumulated $550,804 more than Spender by the age of 65. Key factors to increasing the value of investments is to save early and utilize compounding interest!

The following is some general information to help you understand how stocks, bonds, and mutual funds differ:

Stocks

- You become a part owner of a company when you buy stock in it. If the company does well, the value of the stock increases. You make money by selling stock when it’s worth more than you paid for it.

- You may receive a dividend as a result of the company's profit. A dividend is the sum of money the company pays to its shareholders out of its earnings. Companies usually disperse dividend checks quarterly or yearly. Not all companies pay dividends; instead, they may decide to apply the profits in ways designed to help grow the company and make it more attractive to investors.

- There is no guarantee that stocks will increase in value. In fact, some stocks lose most of their value because of factors such as bad business decisions by the managers of the company, bad timing bringing a product to market, or unfavorable publicity.

- It is important to diversify your stock purchases. A diverse portfolio helps you spread the risk of a market downturn over a range of investments, helping you reduce how susceptible your collection of investments is to losses.

Bonds

- You are essentially loaning your money to the bond issuer —a corporation or government—when you buy a bond.

- Your goal is to earn favorable interest rates and any available tax advantages. With certain types of bonds, you won't be taxed on the interest you earn from them.

- Bonds are called "fixed-income" investments because you receive a set rate of interest over the life of the bond. The bond issuer returns the amount you loaned (your original investment) when the bond "matures" at the end of the bond agreement.

- The safety of a bond depends on the issuer. Credit-rating agencies assign ratings to bond issuers based on their analysis of an issuer’s ability to meet the terms of the loan. U.S. Treasury bonds are considered safe because they are backed by the federal government.

- Buying individual bonds typically is riskier than buying shares of a bond mutual fund. Whichever approach you take, it’s smart to diversify your bond investments to help manage risk.

Mutual Funds

- The mutual fund purchases shares of stocks and bonds in a number of different companies, using money pooled from many investors. A portfolio manager is in charge of overseeing the choices of investments within the fund, sparing you the time required to research individual companies you may want to invest in.

- The value of the mutual fund may go down if the fund’s holdings go down in value. The opposite is true, too. Changes in value may result from factors such as an overall economic change or a shift in investor confidence in a particular sector of the economy.

- The amount you earn in a mutual fund is not guaranteed, unlike a deposit you make in a savings account with a certain guaranteed interest rate.

- Stock mutual funds tend to be better suited for long-term goals. The stock market is unpredictable over the short term, but historically it has produced earnings over the long haul that outpace inflation.

Be sure to research a mutual fund before investing in it. Start with the fund's prospectus, a document for investors that every mutual fund is required to issue.

For additional information on investing, check out the American Association of Individual Investors and the Financial Industry Regulatory Authority (FINRA).

Even though your retirement is a long way off, investing just a small amount of money each month (perhaps automatically from your paycheck) now will allow many more years for you to grow your investment portfolio. The earlier you start saving for retirement, the greater you can build your income cushion to support you in your retirement years. A retirement savings plan is a critical part of securing your retirement. There are many investment options to improve your retirement. For more information, please visit Employment to Retirement.

Common Retirement Funds:

- 401(k). A tax-deferred retirement plan that allows you to set aside pre-tax dollars from your paycheck to save for retirement. The main advantage of a 401(k) is the employer match up to a certain amount.

- 403(b). Similar to a 401(k), but for nonprofit companies such as school districts, religious groups, and governmental organizations.

- Traditional IRA (Individual Retirement Account). A retirement account which allows individuals to place pre-tax income towards investments, and the dividend income is paid when withdrawn after age 59 1/2.

- Roth IRA (Individual Retirement Account). A retirement account which allows individuals to place after-tax income towards investments, and the earnings can be withdrawn tax-free after age 59 1/2.

Financial Literacy Recommendations

|

|

|

| Annuity.org has been providing visitors with carefully researched, timely information about annuities and structured settlements for nearly a decade. This free, comprehensive web resource offers professional insight from experienced financial experts on a variety of financial topics to help you make smart decisions about your money. | An online tool for nonprofit universities and colleges. CashCourse® offers a wealth of financial education resources for schools and their students. CashCourse® provides students the resources to build the financial skills they need to get through college and prepare for their future financial lives. | GradReady is an online money management website that contains videos and tools about topics that include credit, student loans, and identity theft, which will empower students to make sound financial choices before, during, and after college for lifelong financial wellness. |